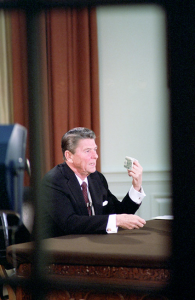

President Reagan’s Address to the Nation on the Economy (February 2, 1981)

On February 2, 1981, Ronald Reagan addressed the general public from the Oval Office in the White House with a grave message: the United States was facing its most serious recession since the Great Depression. In this specific photo, Reagan is discussing what is regarded as the most striking example of the state of the economy. He held up a singular dollar bill, saying that a dollar made in in 1960 was worth only thirty-six cents in 1981, a shell-shocker to most Americans. He continued that government programs that had seemed previously worthwhile were sucking inordinate amounts of money out of the hands of the people and contributing to the ballooning national debt. Having run on a campaign standing firmly on the notion of scaling back government, this demonstration only corroborated his proposals. By citing this example, Reagan perfectly outlined why limiting the scope of government would better the American economy.

The Economic Recovery Tax Act of 1981 (August 31, 1981)

“An Act to amend the Internal Revenue Code of 1954 to encourage economic growth through reduction of the tax rates for individual taxpayers, acceleration of capital cost recovery of investment in plant, equipment, and real property, and incentives for savings, and for other purposes.”

This excerpt from the Economic Recovery Tax Act of 1981 enumerates Reagan’s goal of reducing individual taxes into federal law. Upon taking control of the dire economic situation into which he was thrust when he assumed the presidency, Reagan went to work as fast as possible to reverse what he thought to be excessively burdensome taxes in order to encourage spending that would stimulate the economy. Reagan managed to cut income taxes on the top tax bracket by twenty percent, declining from seventy percent to fifty percent in just two years while simultaneously reducing the capital gains tax and creating a higher estate tax exemption through this act. The economy showed immediate signs of life and recovery, with wages sharply increasing and a Gross Domestic Product rising following the passage of the legislation. This hands-off approach by the government was present in most legislation passed during the Reagan administration but most notably in economic policy.