Sara Johnson, Class of 2018

Q: How do you define financial literacy, and what topics interest you most?

A: I think i am still learning how to define financial literacy because there is so much to learn based on changing regulations or expectations. However, to keep it simple, it is important that I know the basics and see how it has a personal connection to me.

For student loans, this could be knowing how much I owe, making a repayment reschedule, knowing my point of contact, how I can pay my loans quicker, etc.

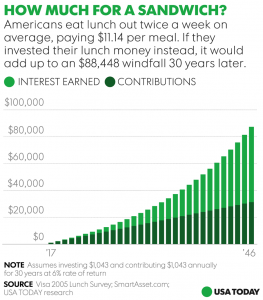

Recently, some of the YouTube videos I watch, like The Financial Diet, and other articles mention that it important to start investing as a young adults. Although, I am still trying to learn more and actively participate in investing, it has been great to connect with people who know more about this subject.

Other financial interests-Also, I have read articles and watched documentaries about cryptocurrency like Bitcoin. On campus, I attended the panel on the subject, which provided more information on the future and skepticism of cryptocurrency. Very interesting panel. Overall, student loans, investing, and cryptocurrency are the topics I am most interested in now.

Q: What is your personal money philosophy?

A: I am not sure where I heard this quote, but it said “spend money on experiences not things”. There are exceptions to this statement- if you need to buy a TI-83 calculator, for example, for your career path or personal happiness–buy it. Saving money is great, but don’t skip out on opportunities that could help you find your career path or deepen your relationship with friends, family, etc.

It is important to invest in yourself. I am still learning this, but it is important to do this for your personal well-being and future.

Lastly, If you have a tendency to spend money when you have quick access to it, put it in a separate account so that you will have to think about using the money when logging in.

Q: Do you keep a budget? Why or why not?

A: In the traditional sense, I don’t think I have a complete budget because I don’t allocate a certain amount of money to a category. I base my “budget” on how much I can spend and what I want to save. So, I base my purchases from that amount. When I want to purchase something, I weigh the pros and cons of each item.

When it comes to large purchases like college tuition, I look for scholarships that would help.

Q: Did you have exposure to financial literacy when you were growing up?

A: Most of my financial literacy comes from YouTube videos, articles, and talking with people who are familiar with the subject. This happened closer to the end of my high school and college days.

Q: Have any events at Dickinson inspired you to change your financial habits?

A: I wouldn’t say these events completely changed my habits completely, but I learn a lot from the Loan Information session and the Bitcoin panel. Also, being an executive member of an organization taught me how to write and organize a budget.

Q: What financial literacy-related advice would you give first year students/students in general?

A: Six years ago, the national student debt reached 1 trillion dollars. On this day, there were many organizations that wanted to educate students and the general public about loans, debts, payment options, Department of Education and more. Although this topic can seem daunting (it can be!), it is important to reach out to people to understand how you can address your loans. Even if you don’t have loans, it is important to understand this since it is a national issue. Reaching out to people can be helpful in other topics of financial areas too.

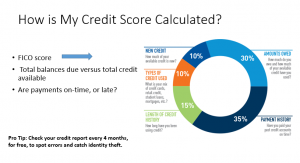

Notes from our presentation on credit scores.

Notes from our presentation on credit scores.