The deadline to file taxes for 2017 is April 17, 2018.

With one week left to file, you might feel overwhelmed – but don’t panic! Many students will be able to use the step-by-step instructions below to get started and file their federal return for free.

Step 1: Do you need to file?

The Interactive Tax Assistant will help you find out.

Review your 2017 earnings and take this quiz from the IRS: https://www.irs.gov/help/ita/do-i-need-to-file-a-tax-return

Step 2: Gather your documents and information.

You will need:

- Your Social Security Number

- Your Permanent mailing address

- W2 forms from every employer you had in 2017

- A record of cash earned from odd jobs, for which you will not receive an income tax form

- Determine if you had health coverage for the entirety of 2017

- Your bank account information (for electronic refund); you’ll need the financial institution’s routing number and your personal account number, both easily found on a blank check

In rare cases, a student might need:

- 1099-MISC forms if you worked for someone but were not considered an employee

- 1099-E if you made any payments on your student loans in 2017

- 1099-INT or 1099-DIV if you received interest or dividend payments from investments in your name

If you have special circumstances, including but not limited to the following list, please see a tax professional as soon as possible:

If you have dependents.

If you have interest or dividend income.

If you have small business income, a capital gain, or other types of income beyond those listed on a W2, 1099-MISC, or cash payments.

If you made payments on a student loan in 2017, or if you want to try to claim any education-related tax credits. (Learn more here: https://www.irs.gov/individuals/students)

If you feel any part of these instructions doesn’t fully capture your unique situation.

Step 3: Determine your filing status.

You can use the IRS Tax Assistant to determine your status: https://www.irs.gov/help/ita/what-is-my-filing-status

In some cases, you will be able to skip this step and rely upon the tax filing software you will use in step 5.

Step 4: Find out if you are someone else’s dependent.

In most cases, it will be important to talk with your parent(s) to find out if they will claim you as a dependent on their tax return. If you have contact with your parent(s) be sure to have a conversation with them before you claim yourself as an exemption on your tax return.

Step 5: Use the IRS Free File resources to complete your federal tax return.

Start at https://www.irs.gov/ and select Free File:

Most students will be eligible for free software because their income will be below $66,000 for 2017. Click on Start Free File Now:

Find the free filing tools that will be best for your unique situation by selecting Lookup Tool:

Fill in the Eligibility Verification form with your own personal details. Here is an example of a 20-year-old student from Pennsylvania, who earned $3,500 at their summer and federal work study jobs in 2017.

Click Continue to see the federal return filing options available for you. Below, you can see the options that were suggested for the sample student, above:

Once you select a free filing tool, you do not have to agree to any “value added” upgrades. These are extras for which a company will charge money – examples include audit protection or credit monitoring. Some students may prefer to use these additional services, but remember you are not required by law to agree to any additional services in order to file your federal tax return.

Step 6: Consider your timeline and circumstances.

Feeling overwhelmed? It is not too late to request an extension to file your return, and if the tax professional cannot complete your tax return before April 17th, they will be able to help you with a request for an extension.

You may also submit your own Extension Form – here is the IRS resource page for filing extensions: https://www.irs.gov/forms-pubs/extension-of-time-to-file-your-tax-return

Step 7: Send them off!

Submit your completed tax return to the IRS after carefully reviewing all of your information. This may be done electronically (for faster tax refunds) or by printing and mailing a return.

Step 8: Think about your state and local responsibilities.

Once you have filed your federal return, be sure to find out if you must also file a state tax return. Some free online programs will allow you to file the state return with relative ease.

You should also see if you received a local (city, school district, county, etc.) tax form. Typically these are mailed to your permanent address.

Step 9: Keep records.

Save an electronic and/or paper copy of your federal tax return, state tax return, and all of your forms (W2, 1099s, etc.). You will need these for a variety of reasons in the future!

Step 10: Follow up and avoid scams!

Keep an eye out for your notification that the IRS accepted you return, your refund (if applicable), and avoid tax scams.

The IRS lists the “Dirty Dozen” tax scams every year (https://www.irs.gov/newsroom/irs-wraps-up-dirty-dozen-list-of-tax-scams-for-2018-encourages-taxpayers-to-remain-vigilant) but in general, they won’t call you and threaten you or request personal information over the phone. Scammers will try to scare you into acting quickly, so you fall for their trap – take a breath and reach out to your local IRS office, or an official IRS help line (https://www.irs.gov/help/telephone-assistance), to find out if the contact was authorized by the IRS.

*Disclaimer: The author of this post and the members of Savē are not tax professionals. This information is intended to help individuals organize their tax-related materials and find safe tax filing resources from the Internal Revenue Service. Filing questions should be referred to the IRS or a tax professional, and this site should not be used as a substitute for advice from a licensed tax professional in your state.

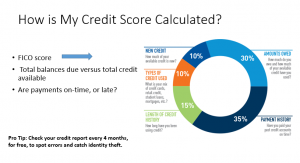

Notes from our presentation on credit scores.

Notes from our presentation on credit scores.