The battle over income inequality became prevalent right before the Reconstruction era and was seen predominately between the American North and South. When the Civil War broke out, it was not only a battle over slavery but also a fight between the Northern industrial and urban wealth against the slave economy in the South (Frederick 2012, 29). As the United States entered the Gilded Age, the wealth gap became more noticeable when an influx of millions of European immigrants swamped the East coast in hopes of obtaining work that would allow them to achieve the American Dream. During this time period, captains of industry such as the Rockefellers and Carnegies dominated the American industry and provided the nation with rapid economic growth while those who worked in factories found themselves not making enough income to support themselves. As the United States shifted from an agricultural economy to an industrialized economy, wages increased and caused more Americans to enter the labor force. The Progressive Era made the concentration of wealth in the United Stated more visible and controversial since many farmers moved to urban areas to find low skilled jobs. This museum exhibition will outline the differences in the wealth gap beginning in the Gilded Age and continuing through to the present-day United States while demonstrating the various types of individuals affected by income inequality and how economic policies affect them.

During the middle of The Great War, the United States began to see the income inequality gap grow drastically, and the share of the nation’s income received by higher income households continued to augment. The increase in wealth gap kept growing as the United States passed through the Great Depression with Franklin D. Roosevelt’s implementation of the New Deal in 1933 as an attempt to strengthen the unions and combat the aftermath of the Stock Market crash. As the economy entered the 1960’s, the United States was becoming a dominant power with wealth and prosperity. The growth was shown as the number of millionaires tripled and as more citizens were becoming rich; with the average family income to rise by 30% in 1968 (Frederick 2012, 30). However, after the 1960s, ordinary Americans found stagflation diminishing their savings, while the economic standing of the wealthy was continuing to grow. With the rising growth for the rich, President Reagan found the supply-side economics useful as he cut taxes in order to bring in more tax revenue, thus allowing the wealth to “trickle down” to the poorer Americans (Frederick 2012, 31). However, between the years of 1977 and 1999, the average after-tax income of the lower half of the population decreased from $10,000 to $8,000, while for the top fifth of the population, the average salary after-tax income increased from $74,000 to $132,000 (Gonzalez 2011, 128). Since the United States became an industrialized economy in the late 19th century, the income inequality gap continued to grow because of how the national income for the United States was split among the population at various income levels and the limitations that accompanied the different levels.

One of the immediate effects of the United States becoming an industrial society and its result on the income gap was the movement from rural villages to urban centers that created new employment opportunities. This shift formed an increasing dependence on markets and money as a medium of exchange, thus producing a barrier between the elite and those who had very limited knowledge of the stock market and how to manipulate the marketplace (Eames 1978, 4). There are two arguments that define the income inequality gap and who is responsible for the high levels of inequality. The first one describes how the poor are responsible for their own condition, implying that the poor need to change themselves as individuals to advance fiscally. The second condition states that the lower income class are victims of a larger social system in which they have a minimal amount of control over and are unable to dictate changes that need to be made system-wide (Eames 1978, 2). These juxtaposing viewpoints provide debates on how to combat the existence of poverty in one of the wealthiest nations while keeping the economy stable. The United States has consistently exhibited higher rates of income inequality than most developed nations because of the support of free-market capitalism and less liberal spending on social services.

During the 1970s the spending on social services increased with the expansion of the welfare reforms in the hopes of helping individuals making less than $7,000 a year. Although there was a decline in real wages for the bottom half of the workforce, the welfare system would entice the poor away from finding lucrative work and moving towards a state of dependency. In the personal account Flat Broke with Children, Hays expresses colleagues’ experiences on welfare in two opposing opinions. One of the colleagues stated that “Welfare reform is the best thing that ever happened,” while another described that “welfare had become a trap and the clients had become dependent” (Hays 2004, 13). Welfare operates as a mechanism of social control to deter middle-class individuals from having to rely on welfare while attempting to discipline those who are unable to support themselves. This system of welfare looks down upon those who are receiving aid and is considered a taboo in society because of the negative connotations that are associated with the topic. American capitalism has undermined the foundations of the middle-class society and created a larger wedge between the poor and rich, making the income gap group significantly prevalent ( McCall 2013, 12). In addition, rising housing costs in the 1970s were adding to the larger income gap and forcing lower income groups to share accommodations and attempt to balance their payments before having their own mortgage (McKenzie 2011, 19). These welfare systems were put into place shortly after the Great Depression began, with many Americans being forced into unemployment and needing a welfare system to support their families because of the drop in personal income, tax revenue, and profits.

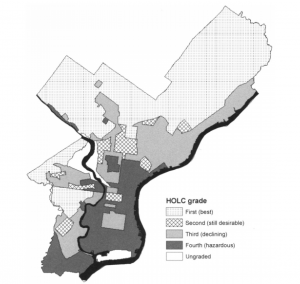

The Great Depression led unemployment to a new high of 25%. The drastic increase in unemployment brought forth the Home Owner’s Loan Corporation to help reduce the number of residential foreclosures by providing loans to homeowners who were going to default on their mortgages. Following these loans came a series of residential security maps that depicted the “desirability” of neighborhoods from a residential viewpoint and were given grades based off of their level of hazard (Hillier 2005, 217). These maps correlated with the practice of not lending to certain areas based on the characteristics of the neighborhood and if it was racially and ethnically different than the white American demographic. This was called redlining and drove a larger wedge into the income gap during and after the great depression. The lack of government and financial help to the areas affected by redlining caused for more Americans to suffer during a time of high unemployment with little supply for jobs (Hillier 2005, 219). The government support allowed the wealthy to stay affluent while driving ethnic and racial families out of their homes and into the welfare system. This prejudice made a larger income gap during and after the Great Depression, keeping individuals with low income stuck in a cycle of poverty with little opportunities.

Since the United States brought together the North and South after five years of fighting in 1865, income inequality has increased and the gap between rich and poor has widened tremendously. To combat the striking difference between the abundance of resources for the wealthy and limited ones for the poor, the United States hoped that with the implementations of the different welfare systems and work plans would revive the United States economy and bring more individuals out of poverty and into the middle class. Through these reforms and the effect of the Stock Market crash in 1929, the United States made attempts to change the wealth gap that still plagues Americans today, while maintaining a free market capitalistic society that supports mass consumerism.

HOLC Map rating Philadelphia areas from best to hazardous in 1935

.