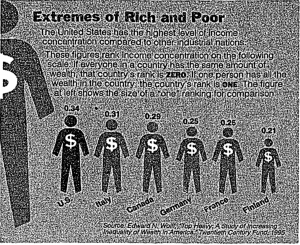

Extreme of the Rich and Poor in 1995: The smaller the person, the smaller the inequality gap is in the country. The United States is the largest person with a ratio of .34. Whereas Finland is the smallest country with a ratio of .21 for wealth inequality.

The Gap in Wealth in the U.S. Called Widest in West

At the time in 1995, the United States had left egalitarian society and become an economically unconventional nation with the economic inequality rising since the 1970s. In the 1980s, the gap broadened between the rich and poor because of the Clinton Republican tax cuts. The Federal Reserve showed figures in 1989 that the richest 1% of American households have a net worth of $2.3 million each and account for roughly 40% of the nation’s wealth. Inequality is rising faster in the United States than other countries because of shocks to the economy that favor the wealthy. These include the decrease in wages for the unskilled workers as automation spreads, low tax rates on the rich during the 1980s, low minimum wage along with the decline of trade unions and finally the rise of the stock and bond markets in the 1980s.

A New Economy

View video: https://search.alexanderstreet.com/view/work/bibliographic_entity%7Cvideo_work%7C2812771

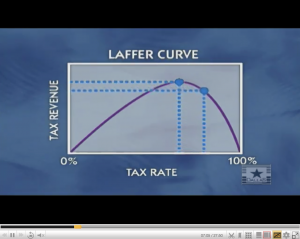

A “New Economy” was necessary to combat the economic struggles in the late 1970s by attempting to make the wealthy better off to increase investment and help generate new businesses to create additional investment for the United States. This idea was created to help make the job market larger with the creation of more salaries. Reagan at the time believed the answer to the income gap was to invest on the supply side of the basic economic model and then demand will fall into equilibrium with the number of people looking for jobs. The idea was to give people more money in their pockets that would give them more money to spend and contribute to the circular flow of the United States. This model was to help heal the wealth gap in the United States; however, it failed because businesses were overburdened with taxation and government regulation and that the government should operate in a free market capitalism. This caused problems for lower-income families because they lacked the resources to be backed financially by the government through the buying of loans, thus keeping them in a cycle of poverty.

The Great Divide: Wealthy Inequality in America

View video: https://search.alexanderstreet.com/view/work/bibliographic_entity%7Cvideo_work%7C3233396

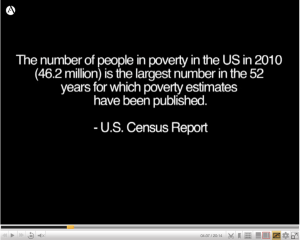

This personal account of the wealth inequality in America that begins with the Occupy Wall Street Movement to shed light on the issue of extreme wealth inequality in the United States. The speaker describes his reasoning for entering the movement as a teen living in New York City and his experience understanding how unequal the opportunities are in the city. The Great Divergence in the 1970s showed how the income gap grew as income growth for households in the middle and lower parties stagnated and were increasing at a decreasing rate, while incomes at the top grew. Furthermore, the unemployment rate and the neighborhoods with the largest income gap ranging between $200,000 and $7,000 a year.

How to Narrow the Gap of Inequality

View video: https://search.alexanderstreet.com/view/work/bibliographic_entity%7Cvideo_work%7C3904323

Bill Gates discusses how to narrow the wealth gap within the United States and compares it to poorer countries that have had success with increasing their wealth growth across all levels of income. He brings the focus towards the United States and the need for progressive taxation and higher taxes for a country that accrues high levels of wealth. The need for equal opportunity in the United States is a theme in the video and uses the example of different inner-city schools and how some may be performing well and have access to health services that other schools may not, limiting the students in the less wealthy school to have the equal chance of becoming a doctor or lawyer. The United States still has a growing wealth gap that is transferring to the education and benefits students and families can receive based off of their position in society and the opportunities they may or may not have been given.

Why America Must Revive Its Middle Class

Through political measures, it is possible and important to bring back the middle-class society and close the gap between rich and poor. One way to increase the size of the middle class is to use the tax code to fight the effects of wage stagnation and tie the tax rates to measures of income inequality. Another mention to revive the middle class is to facilitate the restructuring of long-term debt to keep the generation of students paying back loans not to be constrained to this debt. The passage describes the acceleration of globalization in the U.S. industries such as apparel, auto, and textiles which have lowered the level of middle-class employees in low skill occupations. The American working class has experienced wage cuts and higher unemployment through the high purchasing power of Chinese products.

America was once the great middle-class society. Now we are divided between rich and poor, with the greatest degree of inequality among high-income democracies. The top 1% of households take almost a quarter of all household income–a share not seen since 1929. An economy this lopsided cannot prosper. The poor and working classes are squeezed. The rich are increasingly absenting themselves from the country’s troubles. Their businesses sell goods and outsource jobs to China; their homes are behind gated walls; much of their corporate income is in offshore tax havens.