Dickinson to Durban » Summer Reading Responses » Cap or Tax?

Cap or Tax?

In 2009 the House of Representatives did an astounding thing: they passed the American Clean Energy and Security Act.

This bill had four major components (1):

- It set new standards for power generation and accelerated development of cleaner, more efficient technologies.

- Provides funding for energy efficiency programs and sets higher efficiency standards.

- Creates a Cap and Trade program over 87% of US greenhouse gas emissions.

- Spells out measures for easing the economy into a low carbon state.

Whether or not this was a great piece of legislation was made irrelevant when the Senate killed it, however, as a progressive move towards lowering US greenhouse gas emissions it has implications for what future legislation might look like.

While watching the Clean Energy Works video “The Facts of Cap and Trade” I came to the conclusion that cap and trade was kind of a no brainer. We put an appropriate cap on the US’s emissions and let the effects trickle relatively harmlessly through the market.

But then a watched “The Huge Mistake”, a short video by former EPA workers who claim that the Clean Energy and Security Act is exactly that, a huge mistake. They advocated instead for more of a carbon tax solution.

So what is “Cap and Trade” or “Carbon Taxing”? Which is better?

Well, a carbon tax is exactly that, a tax on carbon. It would most likely be implemented at an “upstream” level, on the energy companies themselves, and the effects would trickle through the market to reach consumers.

Cap and trade is a strategy where a total cap would be put on the entire United States and each company would recieve permits to pollute a certain amount under this cap. Under most models these permits would be “tradeable” to allow for more flexibility.

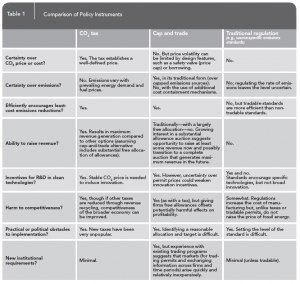

“Issue Brief Five” by Parry and Pizer illustrates many of the pros and cons of these two strategies. In fact, they even created a very nice table (Fig. 1). Basically what it boils down to is that the cap and trade model would be more efficient in controlling actual emissions, while a carbon tax would be less dangerous to the economy and more difficult to cheat out (2). Throughout all of the information I have read on the two models the only conclusion I seem to have come to is that no one can seem to agree on which is better.

Fig. 1 - Parry & Pizer Pros and Cons (2)

With the limited knowledge I have of both I personally believe carbon taxing would be the best option, for right now at least. The United States cannot afford to implement policy that doesn’t allow for economic flexibility at least at first. We cannot know how the economy will immediately react to such intense regulation. I also don’t think that the government will pass anything that threatens to do so. The other big incentive to implement a carbon tax is the revenue that it would provide. I think that if this revenue was to be put towards decreasing other taxes or implementing sustainable development in other ways it could really be beneficial (2).

Either way, it is clear that business-as-usual is not the way to go if we intend to stop climate change. The “Traditional Regulation” model that Parry and Pizer describe is basically a way to decrease emissions by regulating at an individual power-plant level. It is what we are currently doing. But according to Stavins it will cost 90 percent less to use a cap and trade or carbon tax model than to proceed with traditional regulation in order to meet the same decrease in CO2 (3). Parry and Pizer say it is only useful as a complement to one of the other strategies (2). So we need to come to a decision about which of the two models we want to use, because business-as-usual isn’t the

Works Cited:

1. Larsen, 2009. “The American Clean Energy and Security Act: Key Elements and Next Steps.” http://www.wri.org/stories/2009/05/american-clean-energy-and-security-act-key-elements-and-next-steps.

2. Parry, W. and W. Pizer. 2007. “Emissions Trading versus CO2 Taxes versus Standards,” in R. Kopp and W. Pizer, eds., Assessing U.S. Climate Policy Options. Resources for the Future, Washington, D.C., pp. 79-86.

3. Stavins, 2011. “A Golden Opportunity to Please Conservatives and Liberals Alike.” http://www.huffingtonpost.com/robert-stavins/a-golden-opportunity-to-p_b_911588.html.

Filed under: Summer Reading Responses

Why is it that the government and big business always expect the tax-payers to clean up their mess? Instead of getting us to fund their clean up measures let them stop polluting in the first place. Isn’t the sun the best energy source not dirty oil, etc.

The choice between a cap-and-trade system and a carbon tax involves a complex range of factors. I think the most essential deciding factor is the comparison of certainty involved with each policy. Cap-and-trade has certainty in emission reductions, but lacks certainty in cost. A carbon tax does just the opposite – certainty in cost, but not emission reductions. What it all comes down to is how the market will react to a lack of assurance in either category. My guess is that most would prefer to know the exact economic effect of such a policy.